Chief Executive's overview

The Department of the Prime Minister and Cabinet (DPMC) has had a productive year, with each of our business units progressing an ambitious work programme.

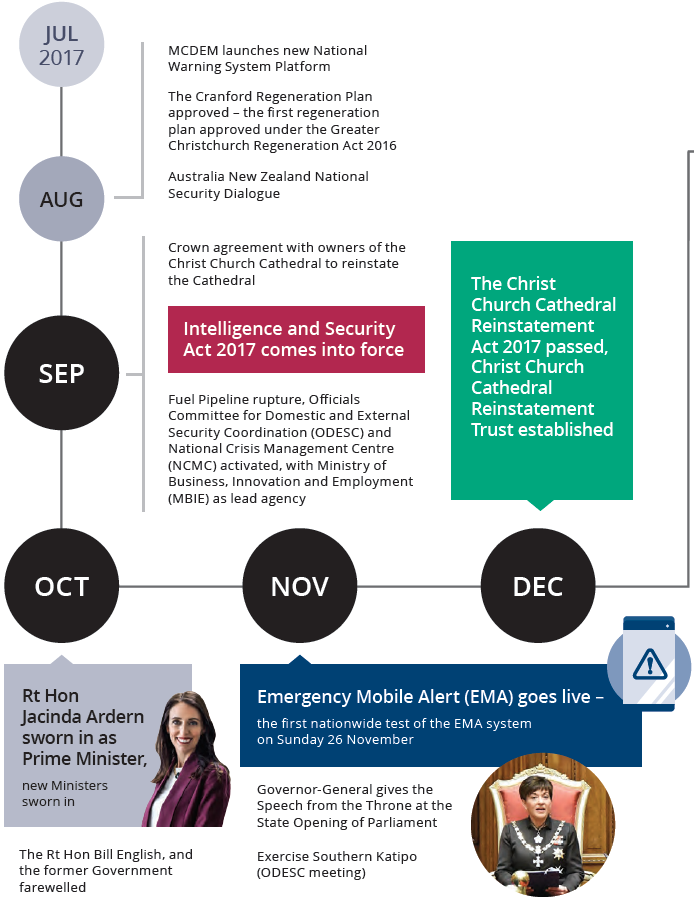

Every year is busy for DPMC, election years more so, and election years where the Government changes, more so again. The 2017 election result meant the Cabinet Office, Government House and the Policy Advisory Group were called on to provide advice and support to the incoming administration, assist with the swearing-in and briefing of new Ministers and the formation of new Cabinet Committees and to coordinate the Public Service's implementation of the new Government's 100-Day Plan. It is always a privilege to support New Zealand's democracy, never more so than at times of transition.

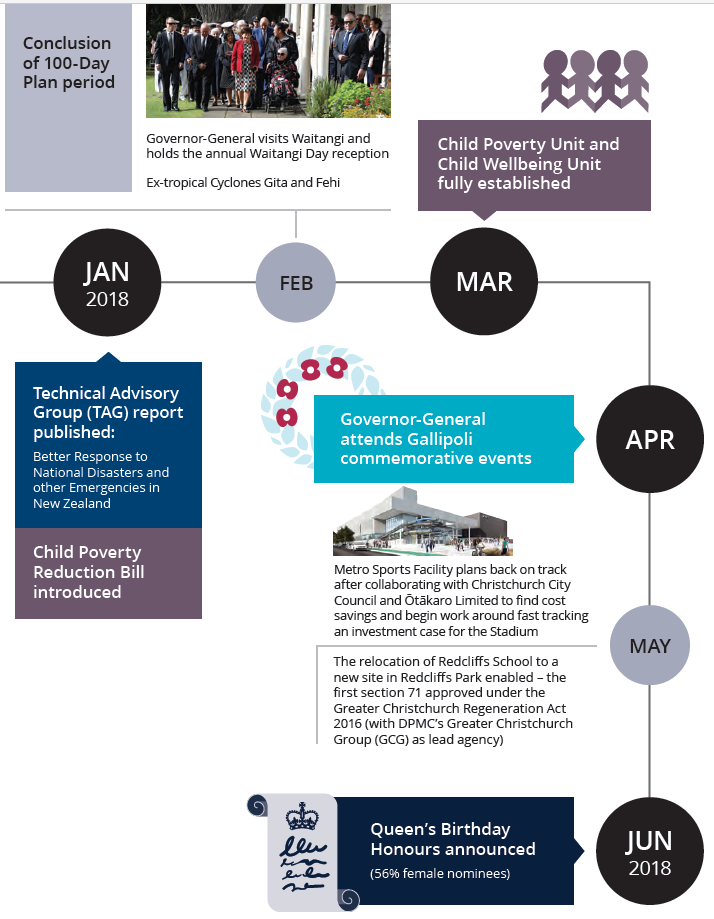

To support the Prime Minister and her Government's priorities, DPMC added two new teams over the year in review - the Child Poverty Unit (CPU) and the Child Wellbeing Unit (CWU). These teams have been established to support the Prime Minister in her capacity as Minister for Child Poverty Reduction.

These teams are developing policy focused on a holistic and long-term view of child wellbeing that addresses factors such as good health and wellbeing, quality education, reduced inequalities, sustainable cities and communities. This work is being undertaken in partnership with Oranga Tamariki and other agencies as required.

DPMC's wider Policy Advisory Group continues to play a crucial role in aligning the Public Service's effort in supporting the Government's priorities and providing free and frank advice to the Prime Minister on all items of government business.

The National Security Group has continued to coordinate and lead a number of initiatives in the national security space, including advancing a system-wide approach to risks. We also supported a number of national security system responses to national security incidents, such as the Auckland Fuel Pipeline Outage and mycoplasma bovis, among others.

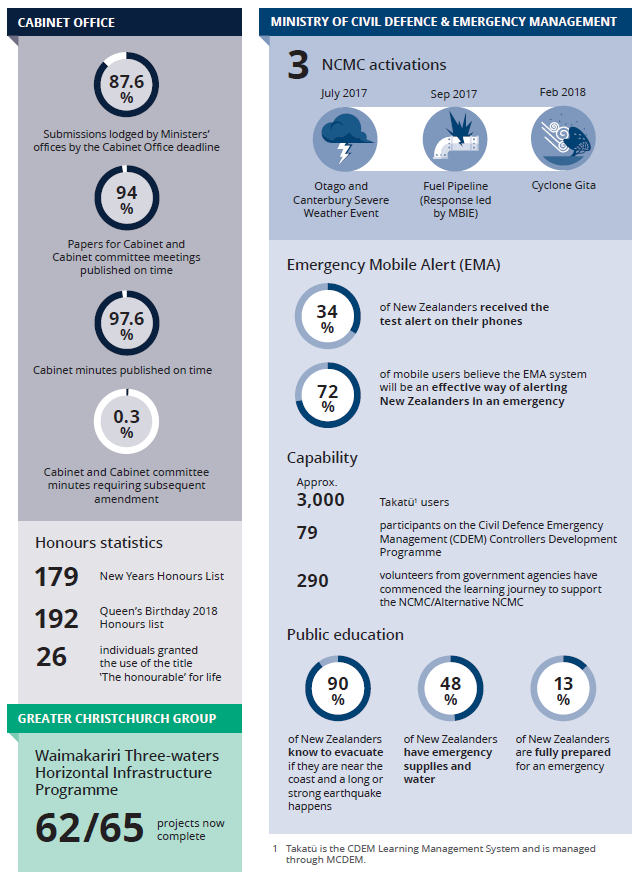

The Ministry of Civil Defence & Emergency Management (MCDEM) continued its work to ensure a strengthened emergency management system and a seamless response to emergencies. During the year, MCDEM launched the Emergency Mobile Alert system, established an alternative National Crisis Management Centre in Auckland and led a series of cross-agency planning programmes, such as the Alpine Fault Earthquake Plan and the revision of the Wellington Earthquake National Initial Response Plan.

DPMC also led work to respond to the findings of the Ministerial Review into Better Responses to Natural Disasters and other Emergencies in New Zealand. At a high level, the review found that the current system has stood up well and is fundamentally sound given the pressures, issues and challenges in recent years, but it also made wide-ranging recommendations to modernise, professionalise and better regulate the system.

The Greater Christchurch Group progressed a number of priority work streams during the year. Milestones include: the approval of the Cranford Regeneration Plan; reaching agreement with the owners of the Christ Church Cathedral to reinstate it; passing the Christ Church Cathedral Reinstatement Act 2017; using section 71 of the Greater Christchurch Regeneration Act 2016 to fast-track the relocation of Redcliffs School to Redcliffs Park; and working closely with Crown entity Ōtākaro and the Christchurch City Council to find cost saving options for the Metro Sports Facility - which is now on track to open by the end of 2021.

Other achievements include establishing a cross-agency insurance taskforce to tackle outstanding Canterbury earthquake insurance issues. We continue to work closely with our strategic partners in Christchurch, including the Christchurch City Council, other local authorities, Te Rūnanga o Ngāi Tahu, Ōtākaro, Regenerate Christchurch, Development Christchurch Limited, Christchurch NZ and government agencies.

Cabinet Office and Government House remain fully engaged with the wide range of duties that come with assisting the government of the day and Ministers, and enabling the range of duties undertaken by the Governor-General. Both are actively involved in providing support for the next high-profile Royal visit to New Zealand, featuring the Duke and Duchess of Sussex.

The June Queen's Birthday Honours List represented six months of work for the Honours Unit in the Cabinet Office. As well as being notable for the wide range of service to the community recognised, this list was also the first time that more women than men have been honoured on a regular list, with women making up 56 percent of the honours announced.

It is only natural that reflection also prompts us to look forward. This coming year will again bring a strong workload as we advance a number of priority areas for the Government, and work on a number of internal initiatives. As a department, we are striving to build our workplace wellness and wellbeing, Māori capability and our flexibility and adaptability. DPMC has a highly engaged workforce who work hard to progress both our business-as-usual work, and step up in times of response. I am grateful for their individual and collective effort, and to the family members and whānau who support them in their work.

This Annual Report foreword is the last I will write for DPMC, as I take up a new role as the Chief Executive and Secretary for Justice in early 2019. It has been an honour and a privilege to serve here for the past six years and I acknowledge the Prime Ministers, Ministers, colleagues and stakeholders that have made it such a rewarding experience. I am confident the Department is well placed for the challenges ahead, and I am pleased to leave the Department in such good heart.

Andrew Kibblewhite

Chief Executive

A - Our Strategic Direction

This section sets out:

- highlights of our year

- who we are and what we do

- our numbers at a glance

- how we measure our performance

- our performance story, and

- where we are going.

Highlights of our year

Who we are and what we do

DPMC is a mid-sized agency of 275 staff located in Auckland, Christchurch, and Wellington.

During 2017/18 our purpose was focused on working with our stakeholders to ensure New Zealanders can live in a confident, well-governed and secure country:

- A confident New Zealand has a strong sense of nationhood and can rely on key institutions and systems to work together in the public interest.

- A well-governed New Zealand means Cabinet decision-making is supported by the best available advice and evidence, and the Governor-General is well supported in her constitutional, ceremonial, community and international roles.

- A secure New Zealand is able to respond to and recover from shocks and stressors in a timely and effective way. It proactively builds resilience with a risk-based, reliable and integrated National Security System (NSS).

Our eight Business Groups achieve our purpose through four main functions:

- Executive government advice and support: serving the Prime Minister and Cabinet.

- Constitution and nationhood: supporting a well-conducted government.

- National security (including risk and resilience): leading an effective national security system, including cross-government arrangements across the ‛4Rs' of risk management: reduction, readiness, response and recovery.

- Greater Christchurch regeneration: providing leadership and coordination of the Crown's regeneration effort.

Executive government advice and support: serving the Prime Minister and Cabinet

The Policy Advisory Group (PAG) provides free and frank advice to the Prime Minister and other Ministers; contributes to policy development across the public service; and leads policy projects commissioned by the Prime Minister.

Taking a whole-of-government view, PAG links agencies to ensure that officials' advice considers broader government priorities. PAG uses a strategic perspective to increase policy coherence and works closely with the State Services Commission (SSC) and the Treasury to promote a collective approach to leadership.

DPMC hosts the Policy Project, to drive policy capability and quality across the public service. The Policy Project supports our Chief Executive, Andrew Kibblewhite, in his stewardship role as the Head of the Policy Profession.

PAG hosted the Child Poverty and Child Wellbeing Units over this performance year. Responding to the Government's commitment to reduce child poverty in New Zealand will involve the development of legislation, strategies and policies through coordination and collaboration across agencies.

DPMC has now formed the Child Wellbeing and Child Poverty Reduction Group to progress these important programmes.

Constitution and nationhood: supporting a well-conducted Government

The Cabinet Office supports executive government to work effectively. Advice and support are provided to the Governor-General, Prime Minister and other Ministers on constitutional, policy and procedural issues; and impartial secretariat services are provided for meetings of the Executive Council, Cabinet and Cabinet committees. The Cabinet Office also helps provide a framework for the Government's legislative programme.

The Honours Unit in the Cabinet Office administers the New Zealand Royal Honours system and assists the Prime Minister and the Cabinet Appointments and Honours Committee to consider nominations.

Government House works with the Cabinet Office to support the Governor-General across the four main duties of the office: constitutional, ceremonial, community-leadership and international. Government House also maintains the heritage buildings and grounds of the residences in Auckland and Wellington.

The Governor-General, Her Excellency the Rt Hon Dame Patsy Reddy, has developed four strategic themes for her term as Governor-General: creativity, innovation, diversity and leadership. These themes shape the Governor-General's busy activities programme, and the work of Government House.

National security

The National Security Group (NSG) leads, coordinates and supports New Zealand's NSS and the New Zealand Intelligence Community (NZIC). DPMC leads the coordination of advice on matters of national security for the Prime Minister, in her role as Minister for National Security and Intelligence. DPMC aims to strengthen the overall security system's support for the Government's priorities; develop better situational understanding; and improve agencies' coordination and collaboration to deal effectively with issues.

The Ministry of Civil Defence & Emergency Management (MCDEM) builds New Zealand's resilience by supporting and enabling communities to manage emergencies. MCDEM provides leadership to reduce risks, be ready for, respond to and recover from emergencies. We manage central government's response and recovery functions for national emergencies and support the management of local and regional emergencies or emergencies led by other agencies.

By working with a diverse range of groups, including local authorities, central government agencies, emergency services, lifeline utilities, research and science and not for profit organisations in support of communities, MCDEM upholds its responsibilities under the Civil Defence Emergency Management Act 2002.

Greater Christchurch regeneration: providing leadership and coordination to the regeneration effort

The Greater Christchurch Group (GCG)oversees the Crown's interests in the regeneration of greater Christchurch. This is achieved through the provision of leadership and coordination across government agencies, engagement with local entities and the community and supporting the transfer of responsibility for leading greater Christchurch regeneration to local entities. Key partners are Ōtākaro Limited, Regenerate Christchurch, Christchurch City Council, Waimakariri District Council, Selwyn District Council, Te Rūnanga o Ngāi Tahu and other regeneration agencies and work includes monitoring the overall progress of regeneration.

Corporate Support and Services

The Strategy, Governance and Engagement Group (SGE) supports the Department to achieve our strategic objectives and manage risk by working across DPMC and ensuring we have sound planning and advice, effective policies, communications and governance and efficient organisational systems and processes. SGE provides the link between the Prime Minister's Office and the PMCSA to assist with her programme of work across government.

The Central Agencies Shared Services (CASS) provides corporate shared services (HR, Finance, IT, information management and publishing) to DPMC. The Treasury provides the service, with DPMC's share of costs funded through an annual CASS charge.

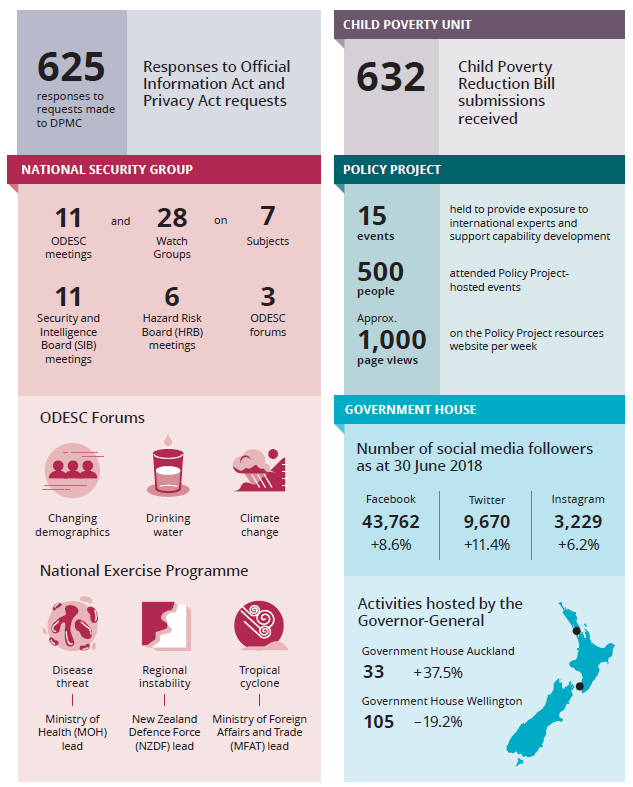

Our numbers at a glance

Our performance story

Delivering on our Strategic Intentions at a glance

DPMC made substantial progress in 2017/18 against our strategic agenda as set out in our Strategic Intentions 2017-2021, in particular, progress against our challenges:

- Challenge One: The public service understands, delivers and helps shape the Government's priorities.

- Challenge Two: Governance for the 21st century.

- Challenge Three: New Zealanders understand and celebrate the institutions and processes that contribute to a strong, shared sense of national identity.

- Challenge Four: Increase New Zealand's resilience through leading and building a risk-based community-focused and integrated National Security System.

- Challenge Five: Leaving the residents and agencies confident in the future of greater Christchurch.

The general election was a significant part of our work programme, and we had a major role to play in 2017. We are proud of the contribution that the many parts of our organisation collectively made to ensure a smooth transition, and provide high levels of support for the incoming Government. While maintaining the systems and processes of executive government, and the provision of high quality advice, we also successfully tried some new things to reflect changes in the way society communicates and receives information (see our feature story on the swearing-in of the new Government under Challenge Two).

The Department took the lead to bring a systems-level focus to issues such as the development of a more systematic approach to national risks (see Challenge Four), as well as where a multi-agency response could deliver a better outcome. This includes our early work with Oranga Tamariki on improving child wellbeing (see our feature story under Challenge One).

We supported the Governor-General to implement new ways of working, with a new strategic framework to shape her work programme, and a revised procedure for royal honours investitures (see Challenge Three).

Throughout the year we worked systematically to build policy capability across the system through a multifaceted work programme (see our achievements under Challenge One).

We worked to build system-level capability elsewhere too. In January 2018, TAG published its report on the Better Response to National Disasters and other Emergencies in New Zealand. We provided advice on the recommendations and assisted preparation of the government response. Other improvements to the NSS included the passing of the Intelligence and Security Act 2017, the launch of the EMA system and progress towards embedding a risk-based approach to the NSS, especially at a governance level.

While there were no major earthquakes during 2017/18 there were a number of significant weather events. We assisted affected communities to respond to these events, and work continues to help these communities and those previously affected by events to recover.

We progressed work to help agencies and the public to prepare for and recover from future events (Challenge Four).

Supporting regeneration in the greater Christchurch area remained a high priority (see Challenge Five). Our work supported the agreement to reinstate the Christ Church Cathedral and fast-track the relocation of Redcliffs School. In conjunction with Crown entity Ōtākaro and the Christchurch City Council, we found cost savings for the Metro Sports Facility - which is now on track to open by the end of 2021.

Other achievements include establishing a cross-agency insurance taskforce to tackle outstanding Canterbury earthquake insurance issues.

We challenged ourselves as a Department to do things better. We established a National Risk Unit to progress the work on nationally significant risk, and formed a National Security Workforce (NSW) team to improve the diversity and capability of staff across New Zealand's national security workforce (see the feature story under Challenge Four).

We also brought together existing policy teams to establish a new National Security Policy Directorate (NSPD) to improve our support for the Prime Minister and relevant Ministers to progress their objectives and fulfil their national security responsibilities.

Alongside these strategic achievements, DPMC also maintained its core business of supporting the government of the day with the best available advice and support in the areas of independent policy advice, national security and intelligence, Cabinet support and support for the Governor-General.

The Department works closely with SSC and the Treasury (the Central Agencies) to lead the public service to deliver outstanding results for New Zealanders. We are collectively responsible for enabling performance to improve across the State sector. We contribute to this by monitoring progress, and promoting and modelling change.

B - Progress in 2017/18

Toward a Confident, Well-Governed and Secure New Zealand

This section sets out our activities and achievement against our five challenges:

- Challenge one: The public service understands, delivers and helps shape the Government's priorities.

- Challenge two: Governance for the 21st century.

- Challenge three: New Zealanders understand and celebrate the institutions and processes that contribute to a strong, shared sense of national identity.

- Challenge four: Increase New Zealand's resilience through leading and building a risk-based, community-focused and integrated National Security System.

- Challenge five: Leaving residents and agencies confident in the future of greater Christchurch.

Challenge one:

The public service understands, delivers and helps shape the Government's priorities

What our goals were:

- Goal One: Understanding and delivery - Mechanisms to articulate and align government priorities are stronger; working with the Treasury and SSC, we support a seamless execution of the Government's priorities.

- Goal Two: Shaping - The quality of policy advice across the public service increases.

What we achieved

Supporting government priorities

2017/18 was a year of transition: PAG supported the outgoing Government with advice and assistance while also providing support to the new Prime Minister and Cabinet to quickly work on their priorities. PAG supported the Government and the public service in taking decisions on, and implementation of the Government's 100-Day Plan. Through leadership and cross-agency collaboration the public service was able to respond well to the 100-Days challenges and support the new Government achieving all the goals it set.

PAG also continued to provide high-level strategic advice on issues of the day to support good decision-making.

Policy capability across the public service

DPMC helped drive continuous improvement in the quality of policy advice and the capability of policy agencies through the Policy Project and our Chief Executive provided leadership as the Head of the Policy Profession.

To support this, the Policy Project team launched an online Policy methods toolbox; provided written guidance titled Writing for Ministers and Cabinet; completed a workforce analysis; and drafted guidance on the Policy Skills Framework, Policy Capability Framework and the Policy Quality Framework.

The Policy Project also developed guidance on free and frank advice and policy leadership (subsequently published by the State Services Commissioner); convened the first Policy Managers Forum; and established the Policy Profession Board, in conjunction with SSC.

Child poverty reduction

The Child Poverty Unit (CPU) and Child Wellbeing Unit (CWU) were established as part of PAG to support the Prime Minister, as Minister for Child Poverty Reduction, and Hon Tracey Martin, as Minister for Children. CPU's role focused on supporting the Child Poverty Reduction Bill and developing policies for reducing child poverty. CWU's role over the past year has been scoping and beginning engagement on a new strategy to promote children's wellbeing.

Sharing our stories

Weaving our strengths - Collaboration to improve the outcomes for children

Our team is gathering information from across New Zealand to inform the development of the country's first Child Wellbeing and Youth Strategy. The first of many hui was on 24 May 2018 when the Prime Minister and Hon Tracey Martin, officials from DPMC and other government agencies participated in a forum of 100 people, themed Weaving our Strengths.

DPMC supported the event, which was organised by the JR McKenzie Trust and the Office of the Children's Commissioner and curated by Inspiring Communities.

This was the first in a planned series of engagements in 2018 to gather the views and ideas of children, young people, families and community stakeholders to seek views on what changes are needed to make wellbeing a reality for all New Zealand children.

Credit: JR McKenzie Trust and the Office of the Children's Commissioner

Challenge two:

Governance for the 21st century

What our goals were:

- Goal Three: Integrated governance - Government decision-making processes and systems are integrated across the public service, support the presentation of high-quality advice to Ministers and facilitate collaborative working.

- Goal Four: Knowledge and support - Newer Ministers have the knowledge and support necessary to carry out their roles and functions.

- Goal Five: Ethical government - Executive government is supported to function in a manner that upholds, and is seen to uphold, the highest ethical standards.

What we achieved

Integrated governance

The Cabinet Office played a pivotal role leading up to, during and after the 2017 general election. We provided policy advice, constitutional advice and administrative support to the Governor-General, Prime Minister, Ministers, their offices and departments.

Knowledge and support

We supported the Prime Minister-elect with advice on establishing the new government, the structure and organisation of Cabinet and its committees and allocation of ministerial portfolios.

Cabinet Office arranged the appointment ceremony following the announcement of the Labour-New Zealand First Coalition, with Confidence and Supply from the Green Party.

We provided in-depth briefings to assist all new Ministers in their roles. Briefings included Cabinet, policy and legislation processes, the Budget cycle, the New Zealand Royal Honours system and, where relevant, national security briefings. We also provided a new induction handbook for Ministers.

Systems support to government

CabNet, our online system that supports Cabinet processes, received a major platform upgrade, including the release of an updated version of the CabDocs application for Ministers. CabNet is now well embedded across 49 central government agencies.

Sharing our stories

Swearing-in of the new Government

A highlight of our work was preparing for and arranging the swearing-in of the new Government. The Governor-General presided over the ceremony to formally appoint Ministers as members of the Executive Council on 26 October 2017, supported by the Secretary of the Cabinet, acting in his role as Clerk of the Executive Council.

Two innovations were introduced for the 2017 ceremony: it was live streamed on the Governor-General's website and Facebook page, and Hon Aupito William Sio swore his oaths in Samoan and English.

During the ceremony, Ministers and Parliamentary Under-Secretaries individually swore their oaths or affirmations and the Governor-General signed 101 warrants of appointment to the Executive Council and ministerial portfolios.

Challenge three:

New Zealanders understand and celebrate the institutions and processes that contribute to a strong, shared sense of national identity

What our goals were:

- Goal Six: Understanding - Increasing numbers of New Zealanders who have a better understanding of New Zealand's system of government, including the office and role of the Governor-General and the Prime Minister.

- Goal Seven: Acknowledging and celebrating honours - New Zealanders acknowledge and celebrate the service, achievement and diversity of recipients of Royal Honours.

What we achieved

Nationhood role

The Office of the Governor-General, and the two Government House properties, have important ceremonial and symbolic roles for New Zealand's nationhood and our system of government. We lifted our achievement this year by:

- upholding the historic connection between the Governor-General, Waitangi and the Treaty and highlighting that connection through three visits by the Governor-General to the far north

- revising the investiture ceremonies for Royal Honours to achieve a more bicultural character

- improving the impact of programme activities (eg, the reception to celebrate Matariki)

- developing connections with new citizens and minority ethnic groups, especially in Auckland

- undertaking a year-long programme of activities commemorating ‛Suffrage 125', and

- increasing the number of regional visits by the Governor-General around New Zealand.

Public understanding

We aim to make sure the public of New Zealand has the greatest practicable access to the Governor-General and to the two properties. We successfully increased both the numbers of invited guests and visitors on tours. This year we made a strong effort to improve public accessibility by enhancing our risk management, security and health and safety for events hosted at Government House.

Social media and the Governor-General's website provide powerful tools to help Her Excellency connect with the general public beyond those she is able to meet in person every year. Our reach increased this year through providing engaging content on these platforms.

Royal Honours celebration

Government House contributed to promoting Royal Honours. We revised the procedure for investitures and we began to undertake small investiture ceremonies at selected locations, other than just the two Government Houses, to bring the Honours ceremonies closer to New Zealanders.

Sharing our stories

The Governor-General leads New Zealand's ANZAC Day commemorations at Gallipoli

Gallipoli is a place of special significance to New Zealanders and Australians, evoking strong feelings for the sacrifices of New Zealanders there. At the Government's request, Dame Patsy Reddy and Sir David Gascoigne led New Zealand's ANZAC commemorations in Turkey, which were attended by around 1,500 New Zealanders and Australians.

Their Excellencies represented New Zealand at seven events on 24-25 April 2018, comprising those commemorating Turkey, the Commonwealth, Ireland, France, Australia, New Zealand and the ANZAC Dawn Service.

Following the Gallipoli observances, Dame Patsy and Sir David went on to Ankara for a meeting with President Erdogan of Turkey, and thanked the Government and people of Turkey for the support they have provided for Gallipoli commemorations over the past century.

Challenge four:

Increase New Zealand's resilience through leading and building a risk-based, community-focused and integrated National Security System

What our goals were:

- Goal Eight: Risk-based - Increased use of risk-based approaches to building resilience in New Zealand, including building community resilience.

- Goal Nine: Community-focused - More New Zealanders - including our priority partners - trust our National Security System to manage shocks and stressors, understand their responsibilities and are prepared.

- Goal Ten: Integrated - We are increasingly seen as providing leadership across the National Security System - from central government, to local government, to the wider community.

What we achieved

Risk-based approaches to building resilience in New Zealand

Our work focuses on national security risks and we work with agencies to be better prepared to manage the consequences when emergencies occur. NSG progressed a risk-based approach to the agenda of the key national security governance boards: the Security and Intelligence Board (SIB) and the Hazard Risk Board (HRB). We are building systems to assist us to analyse, prioritise and treat the most important potential threats facing New Zealand, such as risks from natural hazards, cyber and man-made threats.

We established arrangements to set up an alternative NCMC in Auckland, should the Wellington NCMC be non-operational.

MCDEM delivered and progressed a range of public education activities to help the public know what actions to take before and during an emergency. The public education and promotional campaign for the EMA system raised awareness and understanding of this new source of public information. The planning and launch of the ShakeOut 2018 national earthquake drill and tsunami hikoi was undertaken to provide a reminder of what to do when an earthquake happens, and the highly successful Long or Strong, Get Gone and Drop, Cover, Hold campaigns were promoted to keep these actions top of mind.

MCDEM has strengthened New Zealand's end-to-end warning system for hazards by upgrading the National Warning System which enables faster distribution of messages and voice messaging for potential threats.

Work continued on the development of the new National Disaster Resilience Strategy which is required to be in place by 10 April 2019. The Strategy is focused on building a culture of resilience in New Zealand, and the actions we can all take - at all levels, from individuals and families/whānau, businesses and organisations, communities and hapū, cities, districts and regions and government and national organisations - to contribute to a more resilient New Zealand. Implementation of the Strategy will demonstrate New Zealand's progress toward the priorities of the United Nations Sendai[2] Framework for Disaster Risk Reduction, which advocates for a greater effort towards understanding and managing risk at all levels and in all sectors of society.

We won the 'Best Plain English Turnaround Award' at the 2017 Plain English Awards for MCDEM's preparedness website Happens.nz. Happens.nz helps to educate the public about hazards and emergency preparedness and enable people to create their own household emergency plans.

New Zealanders trust our National Security System to manage shocks and stressors

CDEM groups and local authorities have access to six new or revised guidance documents from MCDEM in addition to the publication of Director's Guidelines, fact sheets, information series, best-practice guides, e-bulletins, supporting plans, technical standards and the National CDEM Plan. The CDEM Act Amendments required a new Director's Guideline on Strategic Planning for Recovery Planning aimed at strengthening recovery practice in New Zealand.

Thirty-four percent of New Zealanders received a test alert on their cell phones on 26 November 2017 when MCDEM successfully launched EMA with a nationwide test. By the end of the 2017/18 year, EMA had been successfully used in four events.

On 3 May 2018 we made a commitment to deaf communities to have improved access to emergency information as the result of signing a new Memorandum of Understanding between MCDEM and Deaf Aotearoa New Zealand. This will provide a foundation to improve information before, during and after an emergency.

Providing leadership across the National Security System

NSG took a lead role in building an intelligence community that has common standards, customer-focused approaches and a joint approach to planning and resource management. The Group established a National Risk Unit to lead the collective development of the National Risk Register by government agencies.

The NSW team was set up within DPMC as a collaborative endeavour by the national security agencies to improve the versatility and capability of New Zealand's national security workforce.

We continued implementation of a Cyber Security Strategy and accompanying Action Plan. We commenced a refresh of the Strategy and Plan to reflect the incoming Government's priorities.

NSG supported lead agencies in responding to significant national security issues by activating the NSS in its response mode, thereby providing additional whole-of-government decision support for agencies and Ministers. The system was activated for 11 Officials' meetings of ODESC and 28 meetings of the senior officials' Watch Group, for a number of events including:

- the fuel pipeline rupture response in September 2017

- the response to the arrival of mycoplasma bovis in New Zealand, and

- a variety of other sensitive national security issues.

MCDEM continued to support local authorities in their management of recovery following the 2016 Kaikōura earthquake and tsunami, the 2017 Whakatāne flooding events and the other areas impacted by severe weather events.

In partnership with Local Government New Zealand, MCDEM produced a webinar in December 2017 to inform mayors and elected officials of their roles and responsibilities during the response to and recovery from an emergency. Thirty-one councils participated and another 24 signed up to the video which can be watched on demand.

In May 2018, MCDEM was proud to host the joint New Zealand National Emergency Management and Australasian Hazard Management Conference. Attended by around 320 people, the theme was Partners for Resilience and provided opportunity for people from across the emergency management sector and supporting agencies to engage, share ideas and inspire collaboration with the aim of building stronger, broader networks and partnerships for improved future emergency management.

Sharing our stories

Building the National Security Workforce

NSW is a cross-agency initiative aimed at building the capability, capacity and career paths for people operating in the highly classified space. The Prime Minister and the Minister Responsible for the New Zealand Security Intelligence Service (NZSIS), Hon Andrew Little, opened two successful National Security Workforce Showcase events in Wellington and Auckland to over 700 members of the sector.

One of the Workforce initiatives is a mentoring programme providing encouragement for women to build a meaningful career in the sector. The programme aims to build a sense of community and provide critical development, support and encouragement to build a meaningful career for women, who make up 43 percent of the workforce.

Mentees are supported by a structured programme, designed to build a strong foundation of leadership practice and with topics of specific interest to mentees. Mentors benefit from the opportunity to give back and hone their skills in listening, guiding and sharing their knowledge.

Due to its success, two subsequent mentoring streams have been included:

- Women in Cyber: targeting women working in cyber security across government agencies/department, and

- New Zealand Intelligence Community Leadership Programme: supporting participants to build and strengthen their leadership.

Challenge five:

Leaving residents and agencies confident in the future of greater Christchurch

What our goals were:

- Goal Eleven: System leadership - Support and influence across the Government to deliver system-wide leadership.

- Goal Twelve: Shape the transition - Support and shape the transition into long-term arrangements for greater Christchurch.

- Goal Thirteen: Maintain momentum - Ensure recovery continues without loss of momentum.

- Goal Fourteen: Lessons and insights - Learning and insights are collated, embedded and put into action so New Zealand is more resilient.

What we achieved

Transition and system leadership

GCG made significant progress in its efforts to ensure that greater Christchurch continues to transition successfully from recovery to regeneration and to foster Christchurch as an attractive and vibrant place to live, work, visit and invest. We maintained strong relationships with regeneration partners through regular engagement, provided ongoing support to their work programmes and actively participated in a number of government groups.

The following milestones were achieved:

- The Independent Hearings Panel concluded a three-and-a-half year process with final decisions on the Christchurch Replacement District Plan.

- The Cranford Regeneration Plan was approved in August 2017, the first under the Greater Christchurch Regeneration Act 2016.

- The fast-tracked Redcliffs School and Redcliffs Park section 71 Proposal enabled the relocation of Redcliffs School to Redcliffs Park.

- Facilitated an agreement with owners of the Christ Church Cathedral to reinstate it (with support from Christchurch City Council and Heritage Groups) in September 2017.

- The Christ Church Cathedral Reinstatement Act 2017 was passed in December 2017.

- Collaborated with Christchurch City Council and Ōtākaro Limited on ways to reduce costs on the Metro Sports Facility and begin work around fast-tracking the Stadium.

Continuing the recovery

GCG also provided policy advice and reporting on the progress of regeneration covering specific projects and performance indicators.

The Waimakariri Horizontal Infrastructure Programme reached practical completion by July 2018. The Stronger Christchurch Infrastructure Rebuild Team (SCIRT) information and systems have now transitioned to the Christchurch City Council (CCC).

Work on the resolution of outstanding insurance claims and establishing a Public Inquiry into the performance of the Earthquake Commission (EQC) continued.

Lessons and insights

Through the EQ Recovery Learning website, GCG continued to collate and disseminate a system-wide body of knowledge, lessons and tools on the Canterbury recovery to help New Zealand prepare for future disasters. The Canterbury Earthquakes Symposium is planned for November 2018.

Sharing our stories

Christ Church Cathedral Reinstatement

The passing of the Christ Church Cathedral Reinstatement Act 2017 (the Act) in December 2017 signalled the next stage of reinstatement for what many see as the heart of Christchurch. This was the final step in a lengthy and complicated negotiation led by the GCG team and now provides a level of certainty and confidence to the public, businesses and investors about the future of the Cathedral.

The Act symbolises the Cathedral's contribution to cultural, social and economic wellbeing in Christchurch, its importance to Christchurch's regeneration and its heritage value. GCG then led and coordinated the establishment of the Christ Church Cathedral Reinstatement Trust (the Trust) and the joint venture with the actual task of reinstatement.

GCG demonstrated its leadership, coordination and consultation expertise through the process by working closely with the Treasury, the Crown Law Office, the Ministry of Justice and many other agencies to ensure an agreeable outcome was achieved. We also kept our strategic partners (Christchurch City Council, Te Rūnanga o Ngāi Tahu and the Canterbury Regional Council) informed and assisted the Church Property Trustees with the cancellation of historic restrictions and conditions applying to the Cathedral land.

This Act also provides for some special provisions covering any plan, programme, bylaw or rule for the period of the Cathedral reinstatement project, providing for a streamlining of some processes (eg, consenting) while still retaining checks and balances.

The Act and setting up of the Trust and Joint Venture are milestones that DPMC is proud of helping to achieve.

Note

- [2]The Sendai Framework is a 15-year, voluntary, non-binding agreement that aims for “The substantial reduction of disaster risk and losses in lives, livelihoods and health and in the economic, physical, social, cultural and environmental assets of persons, businesses, communities and countries.”

C - Our Departmental Health and Capability

This section sets out our:

- workforce capacity and current position

- work to strengthen our workforce and drive our Department's performance, and

- work regarding diversity and inclusion.

Our departmental health and capability

During the year, we made good progress against our Workforce Strategy to be more effective influencers and system stewards, more interconnected and collaborative, less pressured and more resilient.

In developing our people, improving consistency, integration and engagement and building our values, we:

- continued integrating the Leadership Success Profile into our Performance Development process

- reviewed our remuneration processes to close the gap between low- and high-waged staff

- undertook further work on closing the gender pay gap

- implemented a new payroll system and reviewed all policies for pay, allowances and benefits

- commenced our ‛quality conversations' development programme to improve both staff and organisational performance through effective communication

- implemented a new Individual Employment Agreement (IEA) to achieve consistency and improve the record of all grand-parented terms and conditions

- improved staff induction and departure processes to better meet our Personnel Security (PERSEC) requirements

- launched a new survey tool to gain insight about the health of the organisation and undertook a baseline survey

- involved staff in the development of the new DPMC strategic vision and values, and

- reorganised our policy activities to improve quality and alignment with service delivery.

Making sure we have the right staff and skills to deliver our objectives

Recruitment and workforce development have been significant priorities throughout the year. In 2017/18, DPMC recruited 89 new staff (47 permanent, 26 fixed-term and 16 secondees), with overall staff numbers up by 10 percent.

The creation of NSPD ensures a focus on quality advice and gives an ability to respond to changing policy priorities. Staffing changes in Government House also ensure we have the right mix of staff aligned with current priorities.

The addition of CPU and CWU has added a number of secondees, fixed-term and permanent staff.

The short-term nature of some DPMC work (eg, responding to the TAG report) has resulted in secondees and fixed-term employees increasing overall.

Maintaining a safe, healthy working environment

During the year, DPMC:

- implemented a Health and Safety Framework that provides a comprehensive and effective approach

- implemented a framework to ensure staff and information are kept safe

- promoted regular health and wellbeing activities including annual flu vaccinations, vision testing, access to an employee assistance programme and an annual health and wellbeing subsidy

- shared our mental wellbeing journey with other agencies through our Chief Executive's presentation at the Unleashing the Power of Engagement, Health and Safety conference

- signed up to the Business Leaders Health and Safety Forum to commit to the vision of Zero Harm Workplaces, and

- reported regularly on our health and safety journey to our Executive Leadership Team.

Our diversity and inclusion journey

We are committed to a five-year diversity goal of ‛making sure we have a working environment where all employees are valued, included and celebrated for the different perspectives they bring; recognised for the contribution they make; and offered equitable access to opportunities to succeed'.

In 2017/18, we focused on building diversity and inclusion into our priority work programme for culture and engagement. Work has focused on mental wellbeing in the workplace and a new organisational performance survey tool.

We consider integrating diversity and inclusion is a key ingredient for our organisational success - it helps attract and retain talented employees.

DPMC is highly committed to developing, promoting, retaining, and fairly paying its female staff. We have grown the numbers of women in leadership roles from 18 percent to 60 percent; better understood the drivers of a gender pay gap; focused attention on building and retaining female staff; and grown the female participation and development in NSW.

Six years ago, DPMC's gender pay gap was at 25 percent. As at January 2018, the gap had reduced to 10.2 percent, which is lower than the public service pay gap of 12.5 percent.

Mental wellbeing in the workplace

We have successfully delivered organisation-wide training to increase awareness of mental health issues, wellness and the promotion of mentally healthy workplaces. This empowers managers and team members to identify, understand and appropriately support colleagues and to build a culture that focuses on early intervention and supports wellbeing. In conjunction with this initiative, we are promoting access to our wellbeing support, providing quality conversation training, encouraging flexible working, supporting staff to get active and introducing real time pulse checks to see how we are doing. Staff feedback indicated 92 percent are confident they know how to access the right support.

Te Reo/Te Rito learning opportunities

We commissioned a review to understand our internal Māori capability needs, consider what resources are already offered and to identify relevant opportunities for building and strengthening our Māori capability. The review was completed in August 2018 and will guide our approach to Māori capability development over the coming year.

Kōrero Mai - our new organisational performance survey tool

This year we implemented a new staff survey tool with a baseline survey in June to collect staff feedback. The goal of the new survey is to gain insight into more areas of business performance rather than just focus on staff engagement. We also wanted quicker results and the ability to do ‛pulse checks' to allow us to check in with staff as required or to measure if improvement is being achieved through initiatives.

The results of the staff survey are the basis of organisation development initiatives for the 2018/19 year.

Our ethnicity data

The graph above shows individual staff ethnic group alignment (where nominated).

Implementing New Zealand Business Number requirements

The New Zealand Business Number (NZBN) is a universal identifier to help businesses to easily update, share key information and interact with each other. MCDEM has implemented NZBN requirements and we are updating our Financial Management Information System (FMIS) to enable the use of NZBN against our accounts payable, accounts receivable and vendor information. We have updated our stationery from the FMIS to include our NZBN. We are currently investigating the use of the NZBN application-programming interface to match data in our FMIS to the official NZBN data.

Responding to Official Information Act requests

We completed 625 responses to requests made under the Official Information Act 1982 and Privacy Act 1993 in the 2017/18 year. In 2016, we completed 434 responses, in 2015, 418 responses and in 2014, 369 responses.

Managing and mitigating our Department's risk

DPMC's risk and assurance function supports regular management reviews of the Department's top strategic and operational organisational risks. Our Risk and Assurance Committee provides risk and advisory services to our Chief Executive. The Committee includes three external members, including the Chair, and one internal member. During the year, the Committee met quarterly to review areas of potential risk, our progress toward mitigating risks and to discuss a range of other capability and strategic issues.

D - Our Future Direction

This section sets out:

- where we are going, and

- our organisational structure.

Where we are going

We have recently completed a review of our strategic direction. This has provided us with the opportunity to align our direction with the Government's priorities, refine our roles and reset our strategic objectives.

DPMC is committed to advancing an ambitious, resilient and well-governed New Zealand.

We work towards this purpose through our four roles:

- leadership - by working with and across agencies to deliver the Government's agenda

- advice - by providing the Prime Minister and other Ministers with strategic and expert advice

- stewardship - by upholding the principles, systems and processes of executive government, and

- by delivering urgent and important government priorities.

Our work contributes directly to the Government's priorities of:

- building a productive, sustainable and inclusive economy

- improving the wellbeing of New Zealanders and their families, and

- providing new leadership by Government.

What the Department is striving to achieve is structured by five strategic objectives:

- A proactive and responsive public service, helping shape and deliver the Government’s priorities.

- New Zealand’s systems and institutions of executive government are trusted, effective and enhance our nation’s reputation.

- Our cohesive, risk-based national security system makes New Zealand stronger and more resilient.

- New Zealand is the best place in the world for children.

- Christchurch is a dynamic, productive and inspiring place to live, work, visit and invest.

We have developed new values to support our desired way of working: Kia māia. Kia honohono. Kia manawanui. Kia taute. We are: Courageous - We stand up; Connected - We join together; Committed – We believe in what we do; And we do it with Respect.

In the coming year, each of our eight business groups will work to advance our strategic objectives through their own particular areas of responsibility.

The Policy Advisory Group will continue to assist the Prime Minister to focus the public service on the Government's policy priorities through the provision of independent advice on issues of the day.

The Policy Project has six work streams to improve policy capability over the next two years. They are:

- further embedding the policy improvement frameworks across the public service and developing performance reporting for agencies

- supporting the Policy Career Board to help develop policy leaders' capability and mobility

- coordinating the delivery of the Open Government Partnership National Action Plan 2018-20 toward public participation and engagement in the policy development process

- continuing research into data sources to better understand the bigger picture of the policy workforce and its dynamics

- extending guidance and tools to better support the policy community, and

- supporting system change to improve policy outcomes through targeted events and coordinated collective initiatives.

The new Child Wellbeing and Child Poverty Reduction Group will continue DPMC's work to lead the Child Poverty Reduction legislation and to develop New Zealand's first Child Wellbeing Strategy.

The Cabinet Office aims to maintain consistent high levels of secretariat services and constitutional, policy and procedural advice to the Prime Minister, Ministers and their offices in 2018/19. A programme of enhancements to CabNet is planned.

Government House will assist the Governor-General to make a difference through a programme focused around her strategic priorities. Government House is also planning for the long-term maintenance of the two major properties so they remain functioning assets and sources of pride for all New Zealanders for decades to come.

The National Security Group has a number of work streams planned for 2018/19, including:

- launching an updated National Security System Handbook

- continuing work on the New Zealand National Risk Report

- maintaining a focus on national risks and escalating issues for senior official and ministerial attention, and

- further implementation of a customer service approach to intelligence assessments.

The Ministry of Civil Defence & Emergency Managementwill be focused on three priority areas in the 2018/19 year:

- implementing the Government's decisions about improving the system for responding to natural disasters and other emergencies (Ministerial Review decisions) including the establishment of four fly-in teams following new investment

- empowering communities to build resilience and manage risk, and

- supporting communities impacted by a disaster to recover.

DPMC will also implement the Government's policy decisions in response to the Ministerial Review: Better Responses to Natural Disasters and Other Emergencies in New Zealand.

Through the Greater Christchurch Group, DPMC will maintain working relationships with our regional strategic partners to support local institutions in their regeneration activities. In 2018/19, GCG will be:

- providing system leadership and coordination to support local leaders and institutions undertaking their regeneration roles

- supporting the transition of regeneration leadership back to the local level

- ensuring that recovery and regeneration momentum is maintained, and

- ensuring that learnings and insights are documented, embedded and actioned.

The Strategy, Governance and Engagement Group will continue to provide systems and support across DPMC to assist in achieving our goals and objectives. In doing this we will strive for best practice in delivering our corporate functions including strategic planning, communications, ministerial services, performance monitoring and reporting, and ensuring linkages with other government departments. SGE will continue to be the link between the Prime Minister's Office and the PMCSA, and act as the conduit between the Department and the HR, IT and financial services from CASS.

Our organisational structure

E - End-of-Year Performance Reporting Against Appropriations

This section sets out our:

- our Appropriation Statements, and

- Financial and Performance Reporting Against Appropriations.

Appropriation Statements

Statement of Budgeted and Actual Departmental and Non-departmental Expenses and Capital Expenditure Against Appropriations

for the year ended 30 June 2018

| 2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

Where performance information is reported |

|

|---|---|---|---|---|

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Canterbury Earthquake Recovery | 10,306 | 12,030 | 12,190 | Part E |

| Support for Inquiry into EQC | - | - | 592 | Part E |

| TOTAL DEPARTMENTAL OUTPUT EXPENSES | 10,306 | 12,030 | 12,782 | |

| DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Department of the Prime Minister and Cabinet - Capital Expenditure PLA | 172 | 300 | 550 | Part E |

| TOTAL DEPARTMENTAL CAPITAL EXPENDITURE | 172 | 300 | 550 | |

| NON-DEPARTMENTAL CAPITAL EXPENSES | ||||

| Suspensory Loan for Christ Church Cathedral Reinstatement | - | - | 15,000 | Part E |

| TOTAL DEPARTMENTAL CAPITAL EXPENDITURE | - | - | 15,000 | |

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Contributions to Local Authorities Following an Emergency Event | 130 | - | 580 |

Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Crown Contribution for Christ Church Cathedral Reinstatement | 10,000 | - | 10,000 | Part E |

| Emergency Expenses | - | 2,000 | - | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Emergency Management Preparedness Grants | 882 | 889 | 1,041 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Ex gratia Payment to the University of Auckland | 120 | 120 | 120 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Fair Value Write-down of Suspensory Loan for Christ Church Cathedral Reinstatement | - | - | 15,000 |

Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Governor-General's Programme PLA | 1,378 | 1,139 | 1,239 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Governor-General's Salary and Allowance PLA | 410 | 400 | 500 |

Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Governor-General's Travel Outside New Zealand PLA | 241 | 307 | 407 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Remuneration of Commissioners of Intelligence Warrants PLA | 54 | 74 | 174 |

Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Inquiry into EQC | - | - | 216 |

Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| Local Authority Emergency Expenses PLA | 5,078 | 5,000 | 15,000 |

Minister's Report appended to the DPMC Annual Report |

| Rehabilitation of Kaikōura Harbour | 2,470 | 720 | 2,470 | Minister's Report appended to the DPMC Annual Report |

| Restoration of Kaikōura District Three Waters Network | - | 1,800 | 2,400 | Minister's Report appended to the DPMC Annual Report |

| TOTAL NON-DEPARTMENTAL OTHER EXPENSES | 20,763 | 12,449 | 49,147 | |

| MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | ||||

| Emergency Management MCA | Part E | |||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| Community Awareness and Readiness | 2,547 | 1,938 | 2,684 | Part E |

| Emergency Sector and Support and Development | 6,317 | 5,644 | 7,131 | Part E |

| Management of Emergencies | 16,019 | 7,713 | 17,458 | Part E |

| Policy Advice - Emergency Management | 705 | 943 | 531 | Part E |

| TOTAL EMERGENCY MANAGEMENT MCA | 25,588 | 16,238 | 27,804 | |

| Government House Buildings and Assets MCA | Part E | |||

| NON-DEPARTMENTAL OTHER EXPENSES | ||||

| Depreciation of Crown Assets | 949 | 1,962 | 1,762 | Exempt under section 15D(2)(b)(ii) of the Public Finance Act 1989 |

| Government House - Maintenance | 705 | 600 | 800 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| NON-DEPARTMENTAL CAPITAL EXPENDITURE | ||||

| Government House Buildings and Assets - Capital Investment | 248 | 730 | 980 | Exempt under section 15D(2)(b)(iii) of the Public Finance Act 1989 |

| TOTAL GOVERNMENT HOUSE BUILDINGS AND ASSETS MCA | 1,902 | 3,292 | 3,542 | |

| Policy Advice and Support Services MCA | Part E | |||

| DEPARTMENTAL OUTPUT EXPENSES | ||||

| National Security Priorities and Intelligence Coordination | 10,560 | 10,513 | 10,892 | Part E |

| Policy Advice - Prime Minister and Cabinet | 6,632 | 3,996 | 7,314 | Part E |

| Science Advisory Committee | 725 | 675 | 725 | Part E |

| Support Services to the Governor-General and Maintenance of the Official Residences | 4,126 | 4,209 | 4,020 | Part E |

| Support, Secretariat and Coordination Services | 5,399 | 5,940 | 5,818 | Part E |

| TOTAL POLICY ADVICE AND SUPPORT SERVICES MCA | 27,442 | 25,333 | 28,769 | |

| TOTAL MULTI-CATEGORY EXPENSES AND CAPITAL EXPENDITURE | 54,932 | 44,863 | 60,115 | |

| TOTAL ANNUAL AND PERMANENT APPROPRIATIONS | 86,173 | 69,642 | 137,594 |

Multi-year appropriation

The Department has a multi-year appropriation for output expenses incurred by the Crown for the establishment costs and the development of strategies and planning activities, with communities, stakeholders and decision-makers, for the regeneration of areas in Christchurch.

| 2016/17 Actual $000 |

2017/18 Actual $000 |

Location of end of year performance information | |

|---|---|---|---|

| Appropriation for non-departmental output expenses: Regenerate Christchurch | |||

| 20,000 | Original Appropriation | 17,073 | Minister's Report appended to the DPMC Annual Report |

| 1,073 | Adjustments | - | |

| 21,073 | TOTAL ADJUSTED APPROVED APPROPRIATION | 17,073 | |

| 4,000 | Actual Expenditure | 4,000 | |

| 17,073 | APPROPRIATION REMAINING AT 30 JUNE | 13,073 |

Statement of Departmental and Non-departmental Expenses and Capital Expenditure Incurred Without, or in Excess of Appropriation, or other Authority

for the year ended 30 June 2018

For the year ended 30 June 2018, there has been one item of unappropriated expenditure in Vote Prime Minister and Cabinet.

| Appropriation Type | Appropriation Name | Appropriated Expenditure in 2017/18 Supp. Estimates $000 |

Total Expenditure, Expenses or Liabilities Incurred $000 |

Unapproved or Unappropriated Expenses $000 |

|---|---|---|---|---|

| Non-departmental Other Expense | Rehabilitation of Kaikōura Harbour | 2,470 | 2,470 | 1,145 |

Expenditure in the first four months of the year was $1.145 million above appropriation. This was because confirmation of an expense transfer for the Non-departmental Other Expense appropriation Rehabilitation of Kaikōura Harbour from 2016/17 to 2017/18 did not occur until November 2017 despite expenditure being incurred. This expenditure was in excess of appropriation at the time the expense was incurred (2017: Nil).

Statement of Capital Injections

for the year ended 30 June 2018

| 2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|

| Capital Injection | 300 | 200 | 300 |

Statement of Capital Injections Without, or in Excess of, Authority

for the year ended 30 June 2018

DPMC has not received any capital injections during the year without, or in excess of, authority (2017: Nil).

Reporting Against Appropriations

Canterbury Earthquake Recovery (M85)

This appropriation is limited to provision of services supporting the regeneration of greater Christchurch. It contributes to our strategic objective that greater Christchurch is viewed as an attractive and vibrant place to live, work, visit and invest, for us and our children after us.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| Component: Horizontal Infrastructure | |||

| Monitor and report on progress, timeliness and budget of the Horizontal Infrastructure Programme to Minister(s) and the Treasury, at least twice per year (see Note 1) | Achieved | Achieved | Achieved |

| The Waimakariri Horizontal Infrastructure Programme physical works completed by 30 June 2018 |

New measure | Achieved | Not achieved (see Note 2) |

| Component: Policy and Legislation | |||

| The satisfaction of the responsible Minister with the policy advice service, as measured using the Common Satisfaction Survey (see Note 3), is at least: | 6.5 | 6 | 4.7 |

| A sample of policy advice fits within the target ranges for quality (see Note 4) | Not achieved: 56% scored 7 or more, 16% scored 8 or more |

Achieved | Not achieved: 64% scored above 7, 29% scored above 8 |

| Component: Land and Land Use Planning | |||

| All Crown feedback, reviews and appeals are completed within the statutory and hearings panel timeframes | 100% | 100% | 100% (see Note 5) |

| Component: Leadership/Brokering/Coordination | |||

| The satisfaction of the responsible Minister with the leadership/brokering/coordination role as measured using the Common Satisfaction Survey, is at least (see Note 3): | 6.75 | 6 | 5.3 |

| Component: Monitoring and Reporting | |||

| Report to the Minister(s) at least twice per year on recovery/regeneration progress and the performance of the Regenerate Christchurch Board (see Note 6) | Achieved | Achieved | Achieved |

| The satisfaction of the responsible Minister with the monitoring and reporting activity, as measured using the Common Satisfaction Survey, is at least (see Note 3): | 6 | 6 | 6 |

| The total cost per hour of producing outputs | $104 | $90-$120 | $103 |

Note 1 - This measure is to improve consistency and focus on the number of reports instead of the timing of reporting.

Note 2 - The Waimakariri Horizontal Infrastructure Programme of physical works is expected to be largely complete in July 2018. Waimakariri District Council staff have advised that a small number of storm water projects will continue into the 2019/20 year.

The Horizontal Infrastructure Team will work closely with the Council to determine the eligibility of these projects.

Note 3 - The Common Satisfaction Survey measures Ministers' satisfaction with the quality, timeliness and value for money of policy advice on a scale from 1 to 10, where 1 means fell well short of expectations and 10 means far exceeded expectations. Survey of the responsible Minister as at 30 June 2018.

Note 4 - A sample of the Department's policy advice has been assessed by a panel using the Policy Project quality framework. The target ranges for the quality of our policy advice are that: 70% of our assessed papers will score 7 or more, and that 30% will score 8 or more out of 10, with 10 being the highest quality.

Note 5 - The Christchurch Replacement District Plan is now operative.

Note 6 - This measure reflects the current stage of the rebuild/regeneration rather than recovery. A focus has also been placed on the number of reports produced rather than frequency of reporting.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 19,546 | Revenue Crown | 12,005 | 12,030 | 12,005 |

| 346 | Revenue Other | 201 | - | 185 |

| 19,892 | TOTAL REVENUE | 12,206 | 12,030 | 12,190 |

| 16,038 | Expenses | 10,306 | 12,030 | 12,190 |

| 3,854 | Net Surplus/(Deficit) | 1,900 | - | - |

Expenditure was lower than budget owing to anticipated resolution of a dispute with a supplier and other activity supporting the Canterbury earthquake recovery continuing into 2018/19.

Support for Inquiry into EQC (M86)

This appropriation is limited to supporting the Inquiry into EQC.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| Inquiry's satisfaction with the Support for Inquiry into EQC, as measured using the Common Satisfaction Survey (see Note 1) is at least: | New measure | 6 | N/A (see Note 2) |

Note 1 - The Common Satisfaction Survey measures the Inquiry's satisfaction with the quality, timeliness and value for money of policy advice on a scale from 1 to 10, where 1 means fell well short of expectations and 10 means far exceeded expectations.

Note 2 - For this measure, the actual for 2017/18 is not applicable because the Commissioner had not been appointed by 30 June 2018.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| - | Revenue Crown | 592 | - | 592 |

| - | Revenue Other | - | - | - |

| - | TOTAL REVENUE | 592 | - | 592 |

| - | Expenses | - | - | 592 |

| - | Net Surplus/(Deficit) | 592 | - | - |

Expenditure was below budget as this appropriation was introduced in the Supplementary Estimates and no activity had occurred by the end of June 2018.

Suspensory Loan Christ Church Cathedral Reinstatement (M85)

Scope of Appropriation

This appropriation is limited to provision of a suspensory loan for the reinstatement of Christ Church Cathedral.

This appropriation is intended to achieve the implementation of the Crown's offer to support the reinstatement of Christ Church Cathedral.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| Terms and criteria for advancing the $15 million suspensory loan to support the Christ Church Cathedral reinstatement have been met and the suspensory loan has been advanced | New measure | Achieved | Not achieved (see Note 1) |

Note 1 - Terms and criteria have not been agreed; however, the Joint Venture was signed in August 2018.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| - | Expenses | - | - | 15,000 |

An in-principle expense transfer was approved to bring this appropriation forward to 2018/19.

Crown Contribution for Christ Church Cathedral Reinstatement (M85)

Scope of Appropriation

This appropriation is limited to provision of a Crown contribution towards the reinstatement of Christ Church Cathedral.

This appropriation is intended to achieve the implementation of the Crown's offer to support the reinstatement of Christ Church Cathedral.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| Terms and criteria for payment of the $10 million contribution to support the Christ Church Cathedral reinstatement have been met and grant has been paid | New measure | Achieved | Achieved (see Note 1) |

Note 1 - We have agreed the terms and criteria with approval from the Minister, and payment to the Church Property Trust will occur in 2018/19.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| - | Expenses | 10,000 | - | 10,000 |

Department of the Prime Minister and Cabinet - Capital Expenditure PLA

This appropriation is limited to the purchase or development of assets by and for the use of the Department of the Prime Minister and Cabinet, as authorised by section 24(1) of the Public Finance Act 1989.

Expenditure in 2017/18 was in accordance with the Department's capital asset management plan.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 350 | Property, Plant and Equipment | 151 | 250 | 500 |

| - | Intangibles | 21 | - | - |

| - | Other | - | 50 | 50 |

| 350 | TOTAL EXPENSES | 172 | 300 | 550 |

Emergency Management Multi-category Appropriation (MCA)

The overarching purpose of this MCA is to support communities to be resilient by enhancing their capacity and capability to manage civil defence emergencies. This contributes to our strategic challenge to increase New Zealand's resilience through leading and building a risk-based, community-focused and integrated NSS.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| New Zealand communities are aware of their hazards and risks, are prepared and resilient and are able to respond to and recover from an emergency | 71% | 85% | 86% (see Note 1) |

Note 1 - This appropriation measure is an overall measure calculated by averaging the results of the 17 subordinate performance measures (excluding measures not able to be reported in the financial year). In 2017/18, of the 17 measures, 12 measures were achieved, two were not achieved and we were not able to report on three measures in the management of emergencies category section (see below individual variance explanations).

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 23,990 | Revenue Crown | 25,174 | 16,008 | 25,174 |

| 441 | Revenue Other | 1,866 | 230 | 2,630 |

| 24,431 | TOTAL REVENUE | 27,040 | 16,238 | 27,804 |

| 16,934 | Expenses | 25,588 | 16,238 | 27,804 |

| 7,497 | Net Surplus/(Deficit) | 1,452 | - | - |

Expenditure is higher than originally budgeted owing to funding approvals later in the year for the programme of work to promote disaster resilience in the Pacific (in partnership with MFAT), the emergency management alerting project, and a range of initiatives to support recovery from the Kaikōura earthquake and Cyclones Debbie and Cook. Underspends against the Supplementary Estimates are owing to delays in completing all projects within the year, and are intended to be transferred to 2018/19.

Category: Community Awareness and Readiness

This category is limited to the development and delivery of long-term national programmes to raise individual and community awareness and preparedness.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| Availability of the civil defence website 24 hours a day, 7 days a week, at least: | 99.9% | 99.9% | 99.9% |

| The proportion of New Zealanders who have taken action to prepare for an emergency in the last 12 months, will increase on the previous year by (see Note 1): | New measure | 2% | N/A (see Note 2) |

| The proportion of New Zealanders who know the correct action to take during an earthquake will increase on the previous year by: | 73% | 2% | Not achieved 64% (see Note 3) |

| The proportion of New Zealanders who know the correct action to take if they feel a long or strong earthquake near the coast will increase on the previous year by: | 83% | 2% | Achieved 90% (see Note 4) |

Note 1 - New measure for 2017/18. The baseline for 2017/18 is 50%.

Note 2 - This reflects the historical trend following the Canterbury earthquake sequence, in which preparedness spikes (in this case following the 12 November 2016 earthquake and tsunami), and then tails off. This reinforces our research showing that the biggest prompt for preparedness is large-scale emergencies.

Note 3 - Awareness has declined by 9%, most likely because it has been three years since ShakeOut, our nationwide exercise for promoting this action. ShakeOut is being undertaken in October 2018, and is now an annual event.

Note 4 - An increase of 7% know the correct action to take if they feel a long or strong earthquake near the coast (as established by our annual Colmar Brunton preparedness survey).

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 3,730 | Revenue Crown | 2,661 | 1,915 | 2,661 |

| - | Revenue Other | 63 | 23 | 23 |

| 3,730 | TOTAL REVENUE | 2,724 | 1,938 | 2,684 |

| 3,669 | Expenses | 2,547 | 1,938 | 2,684 |

| 61 | Net Surplus/(Deficit) | 177 | - | - |

Category: Emergency Sector and Support and Development

This category is limited to developing and implementing operational policies and projects, advice, assistance and information to the CDEM sector.

| Performance measure | Actual 2016/17 | Standard 2017/18 | Actual 2017/18 |

|---|---|---|---|

| The number of Director Guidelines, Technical Standards and Codes that are either reviewed or published (see Note 1) will be at least: | New measure | 2 | 6 (see Note 2) |

| Satisfaction is at least 6 in relation to the two measures below (see Note 3): | |||

|

New measure | 6 | 6.6 |

|

New measure | 6 | 6.3 |

| The number of CDEM initiatives developed or implemented in partnership with the public sector, private sector and/or the not-for-profit sector will be at least: | New measure | 5 | 7 (see Note 4) |

Note 1 - Relevant publications are those found on our publications list website.

Note 2 - (1) Emergency Mobile Alert Protocol for User Agencies - Published November 2017; (2) Strategic Planning for Recovery: Director's Guideline for Civil Defence Emergency Management Groups [DGL 20/17] - Published December 2017; (3) Director's Statement: Emergency Mobile Alert Device Standards - December 2017; (4) Quick Guide: Declaring a state of local emergency - February 2018; (5) Technical Standard: Common Alerting Protocol: CAP-NZ - April 2018 (6) CDEM Group Planning: Director's Guideline for Civil Defence Emergency Management Groups [DGL 09/18] - updated March 2018.

Note 3 - Satisfaction performance measure involves a 10-point scale, where 1 means fell well short of expectations and 10 means far exceeded expectations. CDEM sector users include Government departments, local government agencies (including CDEM Groups), emergency services and lifeline utilities.

Note 4 - (1) Group Welfare Managers Forum; (2) Deaf Aotearoa Memorandum of Understanding; (3) National Information Infrastructure Framework; (4) National Emergency Management Development Group; (5) Public Education Campaign; (6) Wellington Earthquake National Initial Response (WENIRP); (7) Emergency Mobile Alerts.

Financial Information

| 2016/17 Actual $000 |

2017/18 Actual $000 |

2017/18 Budget $000 |

2017/18 Supp. Estimates $000 |

|

|---|---|---|---|---|

| 4,856 | Revenue Crown | 5,410 | 5,523 | 5,410 |

| 412 | Revenue Other | 981 | 121 | 1,721 |

| 5,268 | TOTAL REVENUE | 6,391 | 5,644 | 7,131 |

| 5,133 | Expenses | 6,317 | 5,644 | 7,131 |

| 135 | Net Surplus/(Deficit) | 74 | - | - |

Expenditure is higher than originally budgeted owing to funding approvals later in the year for the programme of work to promote disaster resilience in the Pacific (in partnership with MFAT).

Category: Management of Emergencies

This category is limited to management of national emergency readiness, response and recovery, including support to local CDEM organisations, maintaining NCMC in a state of readiness, national training and exercises, coordination and management of central government's response and recovery activities and administration of related expenses.